Personal Finance Flowchart

What is a Personal Finance Flowchart?

Source berrieqkarlee.pages.dev

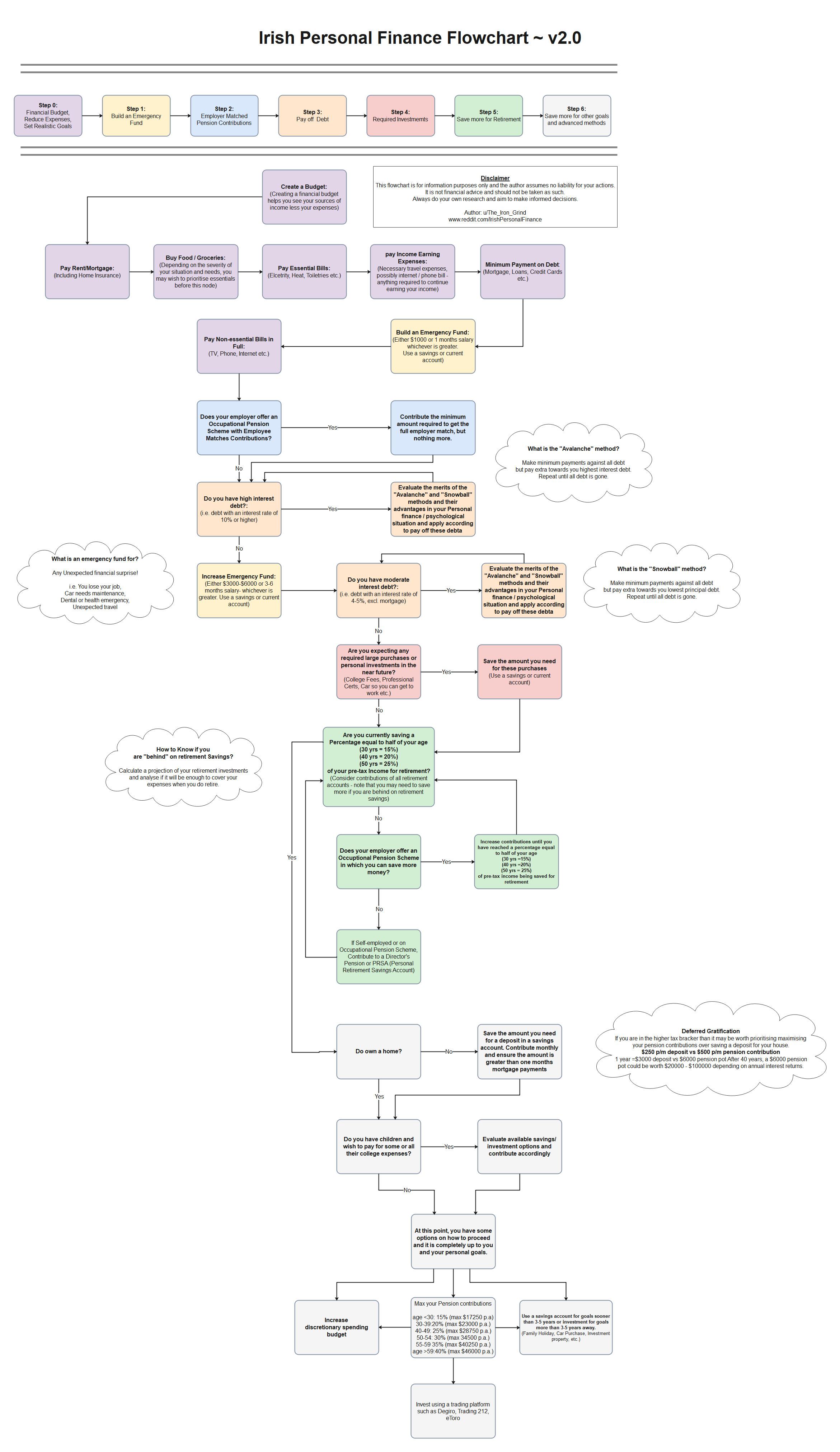

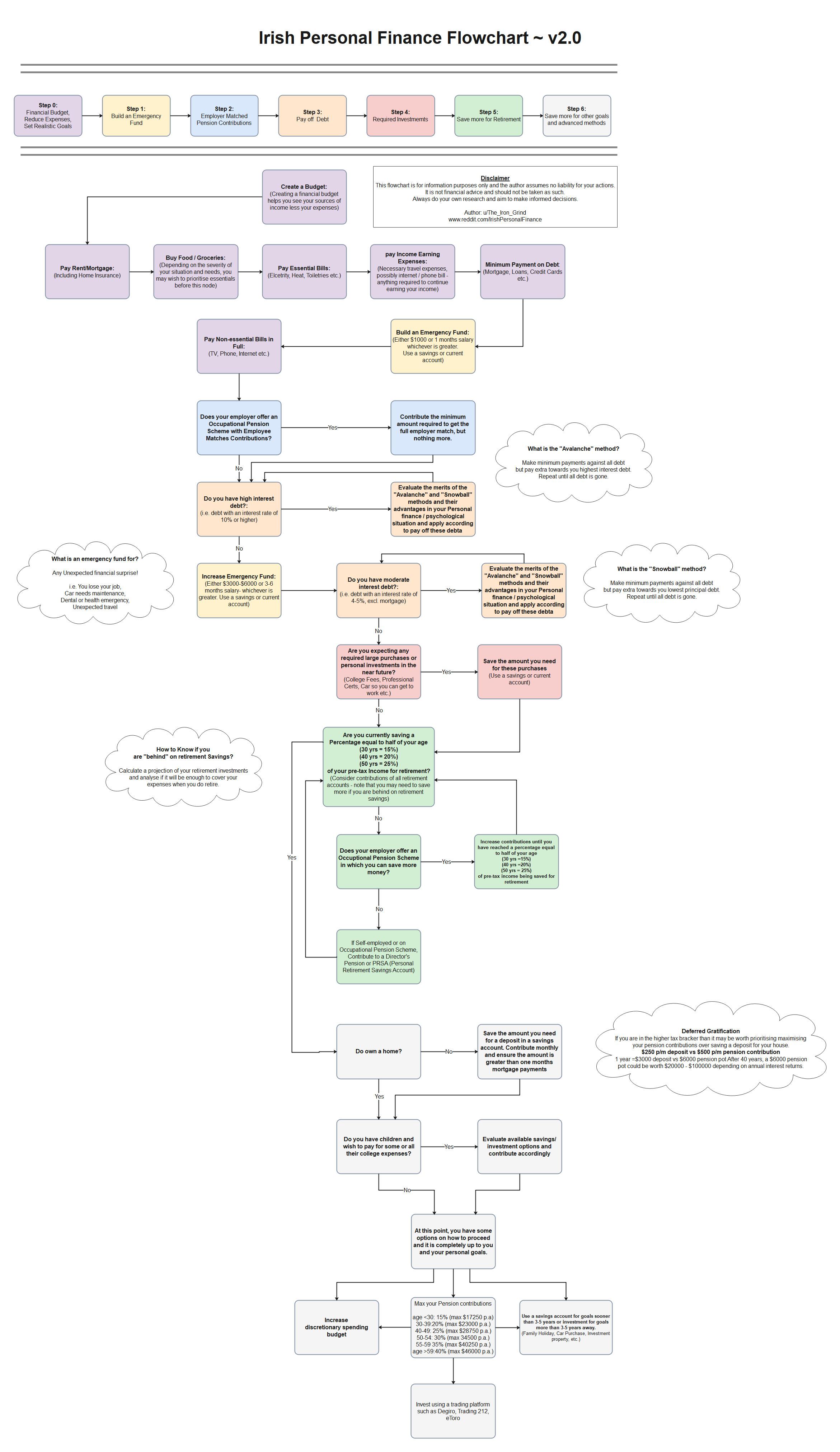

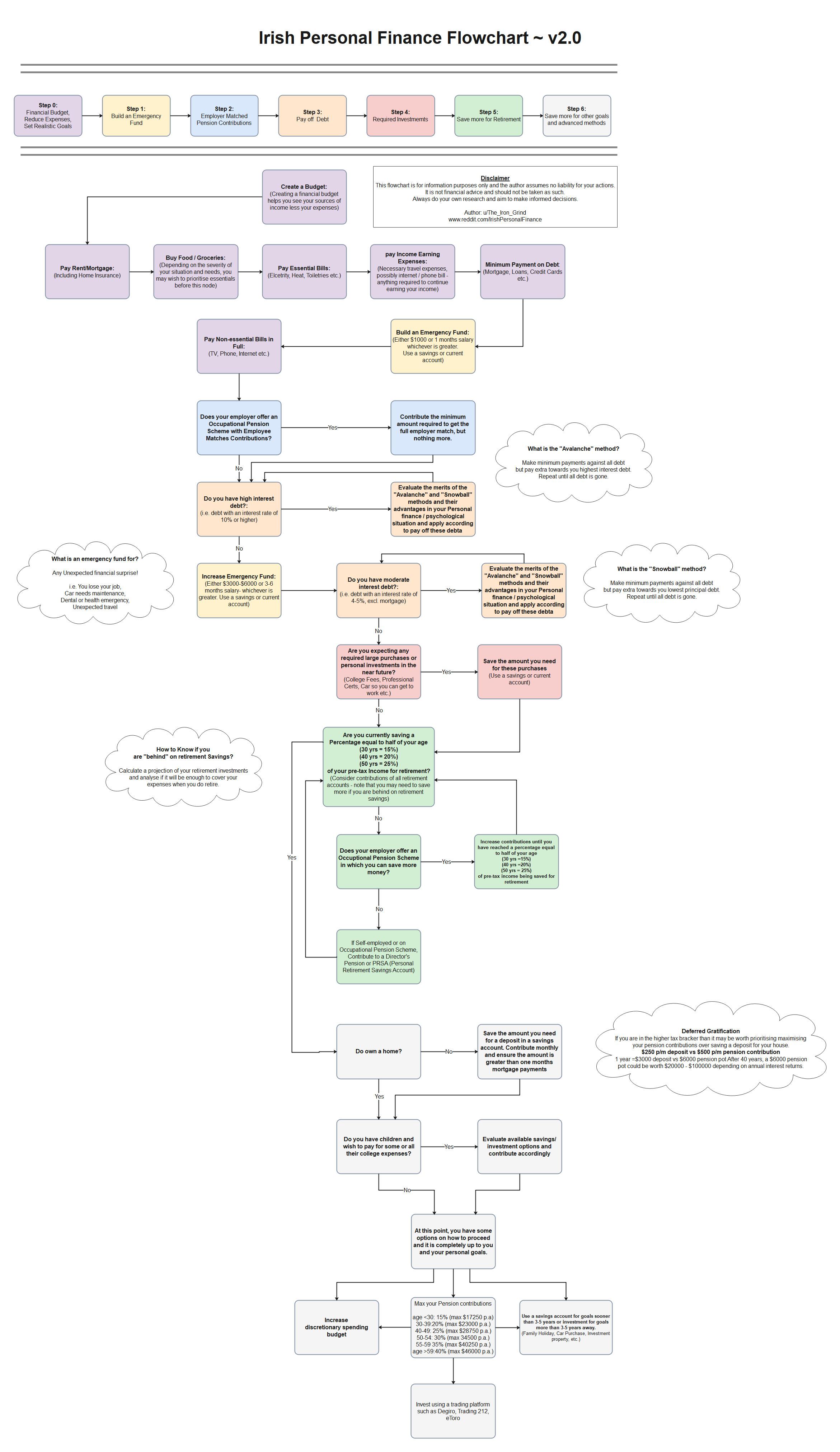

A personal finance flowchart is a visual representation of an individual's financial situation and how money flows in and out. It helps individuals understand their current financial status, track expenses, and plan for future financial goals. By creating a personal finance flowchart, individuals can see a clear overview of their income sources, expenses, debts, savings, and investments in one coherent picture.

Think of a personal finance flowchart as a roadmap to your financial well-being. It serves as a guide to help you make informed decisions about your money and identify areas where you can improve your financial health. Whether you are just starting to take control of your finances or looking to optimize your financial strategies, a personal finance flowchart can be a powerful tool to provide clarity and direction.

Creating a personal finance flowchart involves documenting and categorizing all sources of income, expenses, debts, savings, and investments. Each category is assigned a different color or shape in the flowchart, making it easy to visually distinguish between them. By organizing your financial information in a structured manner, you can quickly identify patterns, track progress towards financial goals, and make adjustments as needed.

Personal finance flowcharts can be as simple or as detailed as you want them to be. Some individuals may choose to create basic flowcharts that outline their income and expenses, while others may include multiple layers of financial information, such as debt repayment plans, retirement savings, emergency funds, and investment portfolios. The key is to tailor the flowchart to your specific financial situation and goals, making it a personalized tool that works for you.

Benefits of Using a Personal Finance Flowchart

Source www.makeuseof.com

A personal finance flowchart is a visual representation of an individual's financial situation, including income, expenses, savings, investments, and debts. By using a flowchart, individuals can better understand their financial standing and identify areas for improvement. This can be especially helpful for those who may not have a good grasp of their finances or struggle to keep track of their money.One of the main benefits of using a personal finance flowchart is that it allows individuals to see where their money is going and how it is being allocated. This can help them make better financial decisions, prioritize spending, and cut down on unnecessary expenses. For example, if someone realizes that they are spending a large portion of their income on dining out, they may decide to cook more meals at home to save money.Another benefit of using a personal finance flowchart is that it can help individuals set and track financial goals. By visually mapping out their financial situation, individuals can see how much money they have available to save or invest towards their goals, such as buying a house, saving for retirement, or paying off debt. This can provide motivation and accountability to stick to their financial plans.Additionally, a personal finance flowchart can help individuals plan for unexpected expenses or emergencies. By including a buffer for emergencies in the flowchart, individuals can be better prepared for any financial challenges that may arise. This can reduce stress and help individuals feel more secure in their financial situation.Overall, using a personal finance flowchart can provide individuals with a clearer picture of their financial standing, help them make better decisions with their money, and work towards achieving their financial goals. It is a valuable tool for anyone looking to improve their financial literacy and take control of their finances.

How to Create a Personal Finance Flowchart

Source berrieqkarlee.pages.dev

Creating a personal finance flowchart can help you visualize and track how money flows in and out of your life. By following these steps, you can organize your finances and make informed decisions about your financial future.

The first step in creating a personal finance flowchart is to gather all your financial information. This includes your income sources, expenses, debts, savings, investments, and any other financial assets or liabilities. Use this information to create a comprehensive picture of your financial situation.

Next, list all your income sources, including your salary, bonuses, rental income, investment income, and any other sources of money coming into your accounts. This will help you understand how much money you have coming in each month and where it is coming from.

After listing your income sources, track your expenses over a specific period, such as a month. Make note of all your spending, including fixed expenses like rent or mortgage payments, utilities, groceries, transportation, and variable expenses like dining out, shopping, entertainment, and other discretionary spending.

Once you have gathered your financial information, categorized your expenses, and listed your income sources, it's time to create categories for your spending. This can include essential categories like housing, utilities, transportation, groceries, and insurance, as well as discretionary categories like entertainment, dining out, travel, and shopping.

Finally, visualize the flow of money in your life by creating a flowchart that illustrates how money moves from your income sources to your expenses, savings, and investments. This visual representation can help you identify areas where you can cut back on spending, increase savings, or make smarter financial decisions.

Tips for Maintaining and Updating Your Personal Finance Flowchart

Source berrieqkarlee.pages.dev

Keeping your personal finance flowchart up to date is essential for staying on top of your financial health. Here are some tips to help you maintain and update your flowchart:

1. Schedule regular reviews: Set aside time each month to review your flowchart and make any necessary updates. This will help you stay organized and ensure that your financial plan remains on track.

2. Update your income and expenses: As your income and expenses change, be sure to update your flowchart accordingly. This will give you a clear picture of where your money is going and help you make informed decisions about your finances.

3. Adjust your financial goals: If your financial goals change, update your flowchart to reflect these new objectives. Whether you're saving for a major purchase or planning for retirement, your flowchart can help you track your progress and stay motivated.

4. Consider using financial software: To make maintaining your flowchart easier, consider using financial software or apps that can help you track your income, expenses, and goals. These tools can streamline the process and provide valuable insights into your financial situation.

5. Seek professional advice: If you're struggling to maintain your flowchart or need help with your financial planning, consider seeking advice from a financial advisor. They can provide guidance tailored to your specific situation and help you achieve your financial goals.

By following these tips and staying proactive about maintaining your personal finance flowchart, you can stay on top of your finances and work towards a secure financial future.

Tools and Software to Help with Personal Finance Flowcharts

.jpg)

Source business.tutsplus.com

Creating a personal finance flowchart can seem like a daunting task, but there are tools and software available that can make the process easier. Budgeting apps like Mint or YNAB (You Need a Budget) can help you track your expenses, set financial goals, and create a personalized budget. These apps often have features that allow you to visualize your income and expenses in a flowchart format, making it easier to see where your money is going and where you can make changes to improve your financial situation.

Financial planning software like Quicken or Personal Capital can also be useful tools for creating a personal finance flowchart. These programs typically offer more advanced features than budgeting apps, such as investment tracking, retirement planning, and tax optimization. They allow you to create detailed financial plans and track your progress towards your goals, giving you a comprehensive view of your financial situation.

If you prefer a more DIY approach, you can use online templates to create your personal finance flowchart. Websites like Canva or Microsoft Office have free templates that you can customize to fit your specific needs. These templates often include categories for income, expenses, savings, and debt, making it easy to organize your finances and see the big picture of your financial situation.

Posting Komentar untuk "Personal Finance Flowchart"