Best Personal Finance App

Introduction

Source www.quytech.com

Managing your finances can be a daunting task, but thanks to the plethora of personal finance apps available, it's easier than ever to keep track of your money. These apps can help you budget, save, invest, and plan for the future with just a few taps on your smartphone. Whether you're looking to create a budget, track your spending, or invest for retirement, there's a personal finance app out there to meet your needs. In this article, we'll take a look at some of the best personal finance apps on the market today. Whether you're a newbie to the world of personal finance or a seasoned pro, these apps can help you take control of your money and reach your financial goals.

Features to Look For

Source www.quytech.com

When choosing a personal finance app, there are several key features to look for that can help you better manage your money and achieve your financial goals. One important feature to consider is budgeting tools. A good personal finance app should allow you to set a budget for yourself and track your spending against that budget. This can help you see where your money is going and make adjustments as needed to stay on track.

Another important feature to look for is goal-setting capabilities. A personal finance app that allows you to set financial goals, such as saving for a vacation or paying off debt, can help you stay motivated and focused on your objectives. Look for an app that allows you to track your progress towards your goals and provides you with tips and strategies to help you reach them.

Finally, it is important to choose a personal finance app that has the ability to track your spending. Being able to see where your money is going can help you identify areas where you may be overspending and make changes to your habits. Some apps even categorize your spending for you, making it easier to see patterns and trends in your financial behavior.

Top Personal Finance Apps

Source en.wikipedia.org

Mint is a widely recognized personal finance app that provides users with a comprehensive overview of their financial situation. With features such as budget tracking, bill reminders, credit score monitoring, and investment tracking, Mint is a one-stop solution for managing your finances. The app syncs with your bank accounts and credit cards to automatically categorize transactions, making it easy to see where your money is going. Mint also offers personalized money-saving tips and insights to help you make better financial decisions.

Source www.pcworld.com

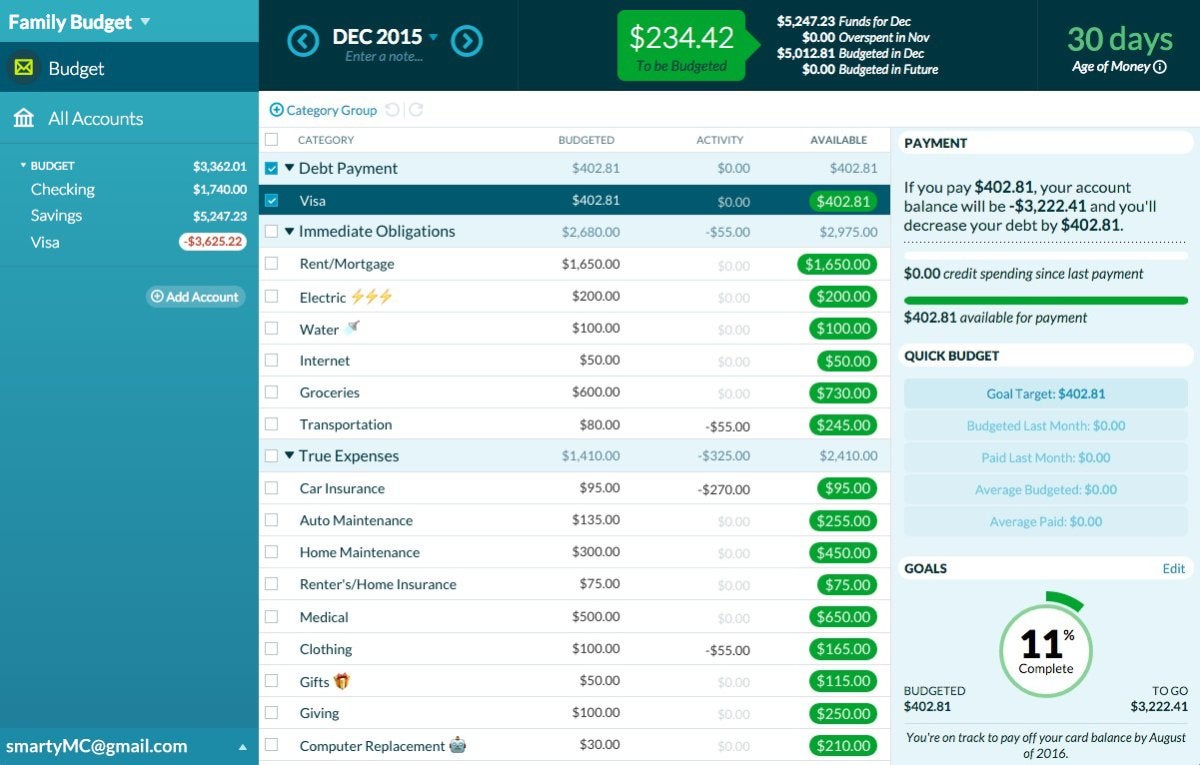

YNAB, short for You Need A Budget, is another top personal finance app that focuses on budgeting and helping users gain control of their money. YNAB follows the principle of giving every dollar a job, encouraging users to allocate their income towards specific expenses and financial goals. The app offers real-time syncing across devices, goal tracking, debt payoff tools, and educational resources to help users improve their financial literacy. YNAB also provides users with support from a community of other budget-conscious individuals, making it a great tool for those looking to get their finances in order.

Source www.pcworld.com

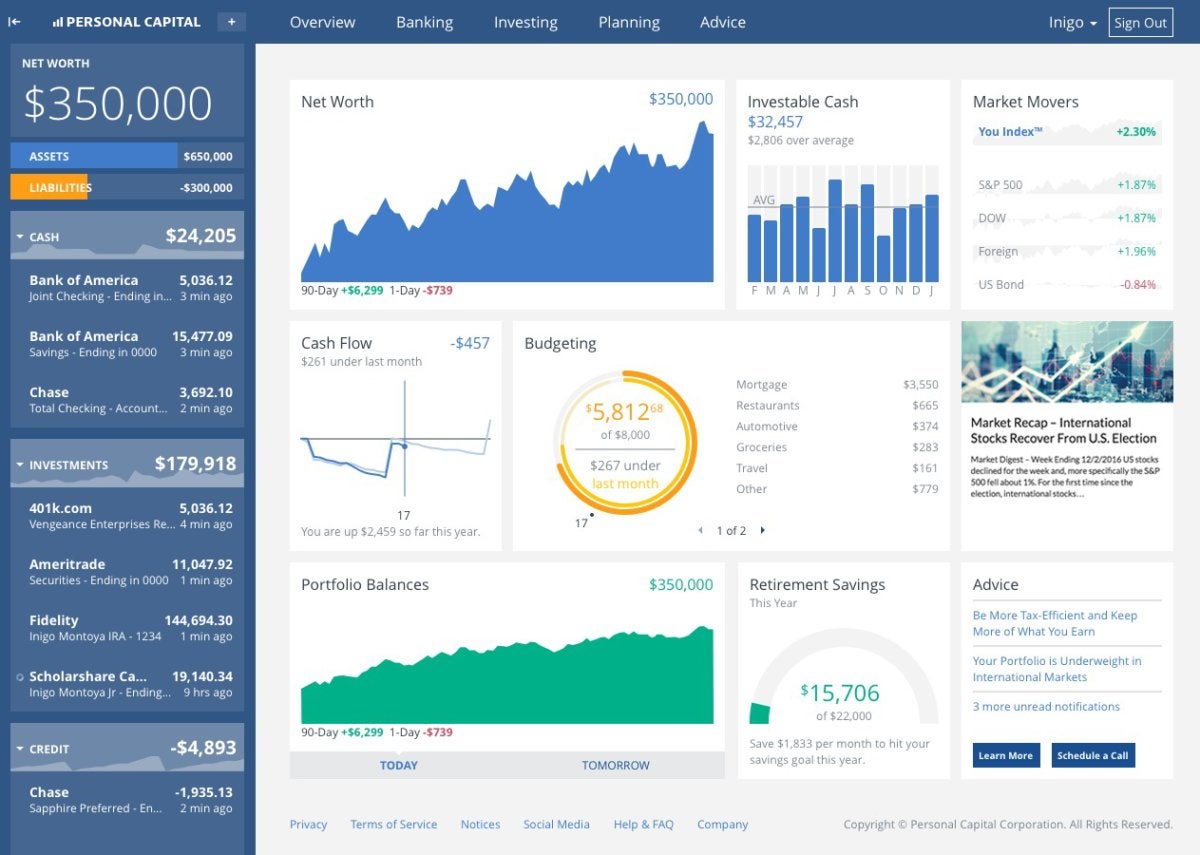

Personal Capital is a personal finance app geared towards investors and individuals with more complex financial needs. In addition to budgeting tools, Personal Capital offers features such as retirement planning, investment tracking, portfolio analysis, and fee analyzer. The app syncs with your financial accounts to provide a holistic view of your assets, liabilities, and net worth. Personal Capital also offers access to financial advisors for a fee, making it a useful tool for those looking to optimize their investment strategy and plan for the future.

Pros and Cons of Using Personal Finance Apps

Source wealthygorilla.com

Personal finance apps have become increasingly popular due to their convenience and ability to help users better manage their finances. They offer a range of benefits, but also come with potential drawbacks that users should be aware of.

One of the main advantages of using a personal finance app is the convenience it provides. These apps allow users to track their spending, create budgets, and monitor their financial goals all in one place. This can save time and make it easier to stay on top of your finances.

Another pro of using a personal finance app is the organization it offers. Users can categorize their expenses, set reminders for bill payments, and visualize their financial data through charts and graphs. This can help individuals gain a clearer understanding of their financial habits and make more informed decisions.

However, there are also some potential drawbacks to using personal finance apps. One concern is the security risks associated with storing sensitive financial information on a mobile device. Users should ensure that they choose a reputable app with strong security measures in place to protect their data.

Additionally, some personal finance apps may come with potential fees. While many apps offer free versions with basic features, users may need to pay for premium services or upgrade to access more advanced tools. It's important to consider the cost and benefits of the app before committing to a paid subscription.

In conclusion, personal finance apps can be a valuable tool for managing your finances more efficiently. They offer convenience, organization, and insights into your financial habits. However, users should be cautious of security risks and potential fees associated with using these apps. It's important to research and choose the right app that aligns with your financial goals and priorities.

Conclusion

Source wealthygorilla.com

In conclusion, choosing the best personal finance app is a personal decision that will depend on your unique financial situation and preferences. Whether you are looking for an app that helps you track your spending, save money, or invest for the future, there are numerous options available to suit your needs. It's important to research and try out different apps to find the one that works best for you. Remember, the best app is the one that helps you achieve your financial goals and makes managing your money easy and convenient. So take your time, explore your options, and find the perfect personal finance app to help you take control of your finances.

Posting Komentar untuk "Best Personal Finance App"