What is Personal Finance

Understanding the Basics of Personal Finance

Greetings, Reader's Friend! Welcome to this comprehensive guide on personal finance. Whether you are just starting your financial journey or looking to improve your money management skills, this article will provide you with valuable insights and knowledge. Personal finance is a subject that affects all of us, and understanding its basics is crucial for achieving financial stability and success in life. So, let's dive right in and explore the world of personal finance together!

Source corporatefinanceinstitute.com

The Importance of Personal Finance

Personal finance plays a vital role in our lives, affecting various aspects ranging from day-to-day expenses to long-term financial security. In this section, we will delve into the significance of personal finance and why understanding its basics is essential for everyone.

With proper personal finance management, you can create a budget, prioritize your expenses, and make informed financial decisions. It enables you to set realistic financial goals, save for emergencies, and plan for major life events such as buying a house, starting a family, or retiring comfortably. Personal finance empowers you to take control of your money and build a solid foundation for a financially secure future.

Moreover, personal finance provides a framework for making smart financial choices in both the short and long term. By understanding the basics of personal finance, you can develop the skills necessary to navigate complex financial situations, make sound investment decisions, and optimize your overall financial well-being.

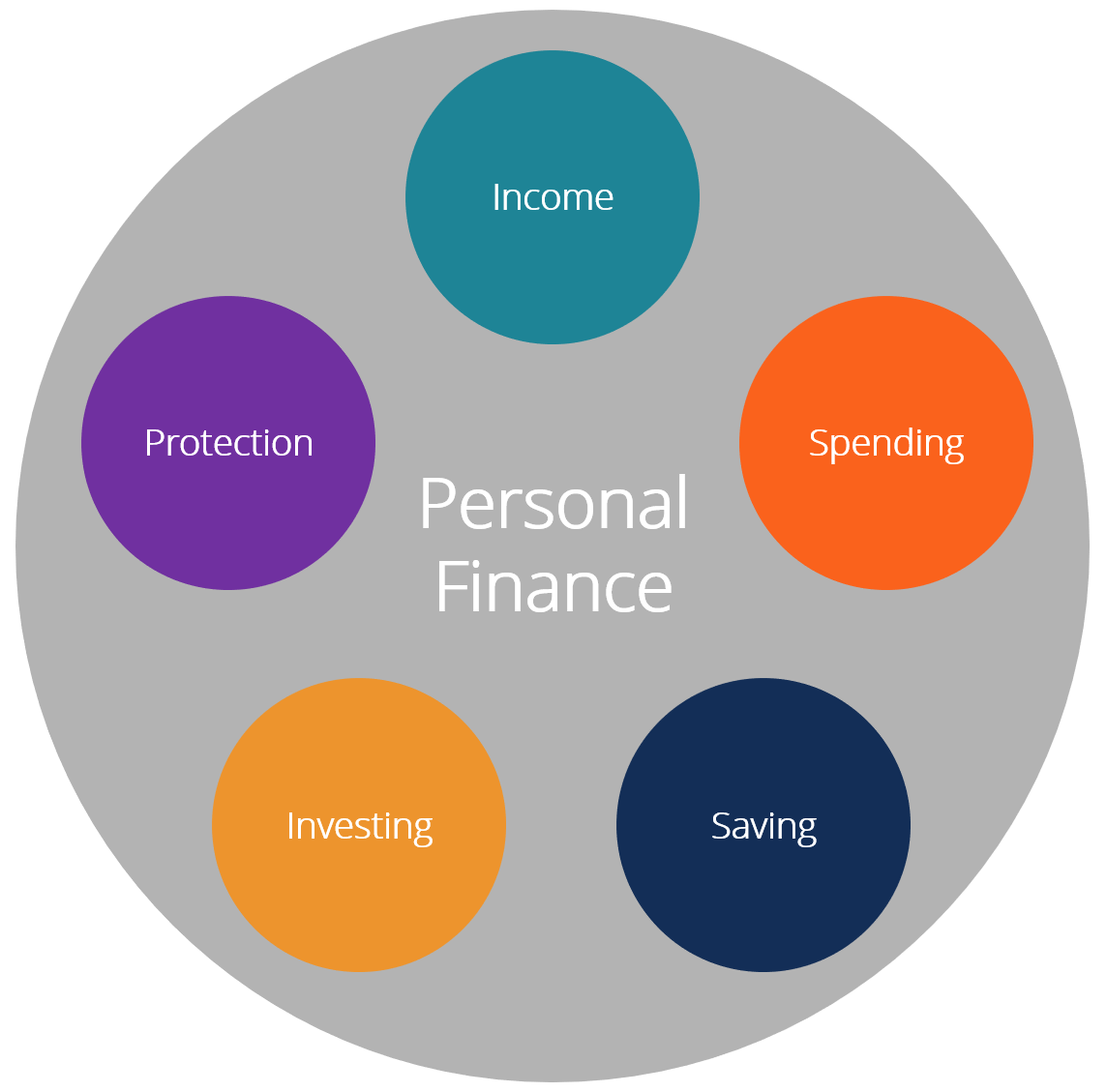

The Building Blocks of Personal Finance

To truly grasp the concept of personal finance, it is important to familiarize yourself with its fundamental elements. Here are the key building blocks of personal finance:

1. Budgeting: A budget is a central tool in personal finance that helps you track your income, expenses, and savings. It allows you to allocate your money wisely and avoid overspending. By maintaining a well-planned budget, you can ensure that your financial resources are being utilized efficiently and effectively.

2. Saving and Investing: Saving and investing are key components of personal finance. They help you build wealth over time by setting aside a portion of your income and putting it to work through various investment vehicles such as stocks, bonds, mutual funds, and real estate. By saving and investing, you can grow your wealth and secure your financial future.

3. Debt Management: Managing debt is crucial for maintaining a healthy financial life. Understanding how debt works, paying off high-interest debts, and maintaining a good credit score are essential aspects of personal finance. By effectively managing your debt, you can reduce financial stress and improve your overall financial well-being.

4. Insurance: Personal finance also involves protecting yourself and your assets through appropriate insurance coverage. Health insurance, life insurance, auto insurance, and home insurance are some common types of insurance to consider. Having the right insurance coverage can provide you with financial security and protection against unforeseen events.

5. Retirement Planning: Planning for retirement is an integral part of personal finance. By starting early and making consistent contributions to retirement accounts like 401(k) or Individual Retirement Accounts (IRAs), you can secure your financial future. Retirement planning allows you to enjoy a comfortable and worry-free retirement.

6. Tax Management: Understanding the basics of taxation and utilizing applicable tax-saving strategies can help you optimize your finances and minimize your tax burden. By effectively managing your taxes, you can maximize your savings and ensure that you are compliant with tax laws.

7. Estate Planning: Estate planning involves preparing for the orderly transfer of wealth and assets to your heirs. It encompasses creating a will, establishing trusts, and designating beneficiaries for insurance policies and retirement accounts. Estate planning allows you to have control over your assets and provides for your loved ones in the future.

Mastering Personal Finance: Tips and Strategies

Now that we have covered the core aspects of personal finance, let's explore some practical tips and strategies to help you make the most of your financial journey:

1. Educate Yourself: Invest time in learning about personal finance concepts, reading books, attending workshops, and following reputable financial blogs and podcasts. The more knowledge you acquire, the better equipped you will be to make informed financial decisions.

2. Create a Budget: Start by tracking your expenses and income. Then, create a budget to guide your spending and saving decisions. Make adjustments as needed to ensure financial alignment. A well-planned budget can help you identify areas where you can cut expenses, save more, and reach your financial goals faster.

3. Prioritize Saving: Aim to save at least 20% of your income. Automate your savings by setting up automatic transfers to a separate savings account or investment portfolio. By prioritizing saving, you can build an emergency fund, save for major expenses, and secure your financial future.

4. Diversify Your Investments: Spread your investments across different asset classes to reduce risk and maximize returns. Consider consulting with a financial advisor to create an investment portfolio tailored to your goals and risk tolerance. Diversifying your investments can help you achieve long-term growth and protect against market volatility.

5. Pay Off High-Interest Debt: Focus on paying off debts with high-interest rates first. Consider consolidating or refinancing your loans to reduce interest expenses. By paying off high-interest debt, you can save money on interest payments and improve your overall financial health.

6. Monitor Your Credit: Regularly check your credit reports and scores to ensure accuracy and identify any potential issues. Maintaining a good credit score can help you access favorable loan terms and financial opportunities. By monitoring your credit, you can identify and address any potential credit issues before they become significant problems.

A Detailed Breakdown on Personal Finance

Let's take a closer look at the different aspects of personal finance with the help of the table below:

| Aspects of Personal Finance | Description |

|---|---|

| Budgeting | Creating and managing a budget to track income, expenses, and savings. |

| Saving and Investing | Setting aside money for future needs and putting it into investment vehicles. |

| Debt Management | Managing and paying off debts, avoiding unnecessary interest expenses. |

| Insurance | Protecting assets and managing risk through insurance coverage. |

| Retirement Planning | Planning and saving for a comfortable retirement. |

| Tax Management | Understanding and utilizing tax-saving strategies. |

| Estate Planning | Preparing for the transfer of wealth and assets to heirs. |

Frequently Asked Questions (FAQs)

1. What is personal finance?

Personal finance refers to the management of an individual's financial resources, including budgeting, saving, investing, and making informed financial decisions to achieve goals and secure a stable financial future.

2. Why is personal finance important?

Personal finance is important because it enables you to take control of your money, make informed financial decisions, save for emergencies, plan for the future, and achieve financial stability and success in life.

3. How can budgeting help in personal finance management?

Budgeting helps track income, expenses, and savings, ensuring your money is allocated wisely and spent according to your priorities. It allows you to identify areas where you can cut expenses, save more, and reach your financial goals faster. Additionally, budgeting provides a clear overview of your financial situation and helps you make informed decisions about your spending habits.

4. How can I start investing for my future?

To start investing for your future, it is essential to set clear financial goals and determine your risk tolerance. Next, explore different investment options such as stocks, bonds, mutual funds, or real estate. Consider consulting with a financial advisor who can provide personalized guidance based on your goals and risk tolerance. Regularly monitoring and adjusting your investments will help you stay on track and achieve long-term financial growth.

5. What is the role of insurance in personal finance?

Insurance plays a crucial role in personal finance by protecting you and your assets from unexpected events. Health insurance, life insurance, auto insurance, and home insurance are some common types that provide financial security and peace of mind. By having the right insurance coverage, you can mitigate financial risks and safeguard your financial well-being.

Conclusion

Congratulations, Reader's Friend! You have now gained a solid understanding of the basics of personal finance. Remember, the knowledge you've acquired here is just the beginning of your financial journey. Keep exploring and learning, as personal finance is a lifelong learning process. By implementing the tips and strategies discussed, you can confidently navigate the world of finance and achieve your financial goals. As you continue on your financial journey, always strive to enhance your financial literacy and seek professional advice when needed. Your financial success is within reach!

Posting Komentar untuk "What is Personal Finance"